How Businesses Can Minimize Risk with ICS/CDARS

In the wake of the Silicon Valley Bank failure, businesses across the country are reevaluating their banking strategy and wondering how they can protect their total deposit balance with FDIC insurance. Typically, FDIC coverage is for up to $250,000 in deposits per depositor. However, IntraFi® Network Deposits℠ (also known as ICS/CDARS) is a convenient workaround to gain FDIC insurance on your full deposit balance, up to $50 million. No, that’s not a typo–keep reading to learn what ICS/CDARS for businesses is and how it can benefit your business.

CAN I HAVE MORE THAN $250,000 OF DEPOSIT INSURANCE COVERAGE AT ONE FDIC-INSURED BANK?

Yes, the FDIC insures business and personal deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category.

Deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at the same bank. For example, a revocable trust account (including living trusts and informal revocable trusts commonly referred to as payable on death (POD) accounts) with one owner naming three unique beneficiaries can be insured up to $750,000. See Revocable and Irrevocable Trust Accounts for more information about how deposit insurance is calculated for these types of accounts.

WHAT IS ICS/CDARS?

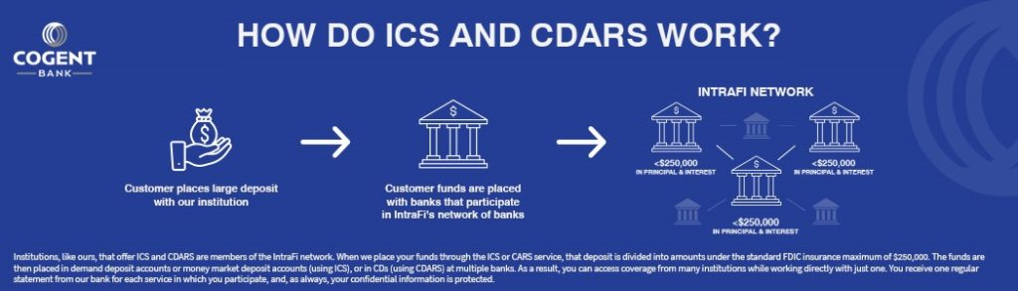

CDARS stands for Certificate of Deposit Account Registry Service and ICS for Insured Cash Sweep. These services are now known as IntraFi® Network Deposits℠, a service that lets you protect millions in deposits with FDIC insurance while also earning a return on your savings. Depending on your cash management needs, you can place funds in a variety of demand deposit accounts such as money markets and CDs. Money deposited through IntraFi Network Deposits will earn a favorable, risk-free return.

Managing cash flow effectively is essential to your business’ financial stability and growth. IntraFi® Network Deposits℠ can help you manage your cash flow efficiently, with as much liquidity as you need, while also growing your savings with interest. And you get the peace of mind, in this turbulent economic time, of knowing your funds are fully insured by the FDIC.

In the rest of this article, we’ll look at all the ways you can minimize risk with a business CDARS account.

DIVERSIFY DEPOSITS

IntraFi Network Deposits is a special network for member banks like Cogent. While you only need to have one banking relationship, with us, your business ICS account funds will be divided into amounts less than $250,000 and placed in multiple member banks. That’s how you get FDIC insurance beyond the standard limit, with 24/7 online access to your business deposit accounts as well as monthly statements. With IntraFi Network Deposits, your deposits are protected in the event of a bank failure. Have questions about the process of diversifying deposits? Just reach out to one of our business bankers and we’ll be happy to help.

SIMPLIFY ADMINISTRATION AND PAPERWORK

With ICS/CDARS, businesses can manage their deposits in a centralized manner, eliminating the need to open multiple accounts at different banks and monitor each account separately. As a Cogent Bank business customer, you can continue to work with the business banking team you know and trust while taking advantage of all the benefits of IntraFi Network Deposits.

Working with one point of contact within one bank will help you simplify the process of managing your business’s savings and other funds. Enjoy the convenience of having just one bank statement with all your deposit account information. Streamline your record-keeping and accounting processes.

MAINTAIN LIQUIDITY

ICS/CDARS offer businesses the ability to maintain liquidity by accessing your funds through one account. This way, businesses can quickly access their cash when needed without having to transfer funds between accounts at different banks. IntraFi Network Deposits can also help businesses maintain liquidity by allowing them to earn a competitive interest rate on their deposits. Depending on your cash flow needs, you can distribute some of your deposits in demand accounts, such as checking or savings, and others in less liquid but higher interest accounts such as CDs.

INCREASE INSURANCE COVERAGE

ICS/CDARS allow businesses to receive FDIC insurance coverage for their deposits up to $50 million, which is significantly higher than the $250,000 coverage limit for individual accounts at one bank. This allows your business to maintain the same level of convenience and access to funds, while also ensuring that all of the funds are FDIC-insured. In the wake of the Silicon Valley Bank failure, utilizing IntraFi Network Deposits will help you mitigate the risks associated with holding large amounts of cash, while also providing your business with greater flexibility and access to funds for cash flow management.

HOW DOES COGENT BANK HELP SMALL BUSINESSES?

Ready to open a business deposit account with CDARS to make the most of your money and manage cash flow effectively? Cogent Bank offers customized business banking solutions to help you achieve your business goals. Whether you are a new or seasoned business owner, our dedicated team of business bankers can help! Learn more about our ICS/IntraFi account, open a new business checking or savings account online, or contact us to get started.

LOOKING FOR ADDITIONAL HELP WITH CASH FLOW MANAGEMENT FOR YOUR BUSINESS?

Check out our Electronic Data Interchange (EDI), which offers automated collection processes to help you accelerate payment and collection, operate more efficiently, enjoy greater flexibility, and save time and money. Cogent Bank is a Preferred Lender for the SBA, which means we can help you process your SBA loan application as quickly as possible.

We also offer a complete list of Treasury Management services including ACH Origination, ACH Positive Pay, Business Online Payroll, Check Positive Pay, and more. To learn more, connect with a Cogent associate. We will discuss your business needs and challenges with you, and help you find the solutions to move your business forward.

Categorized in: Work

This post was written by Elevate, Inc.

Comments are closed here.